What is vehicle data connectivity in the automotive industry?

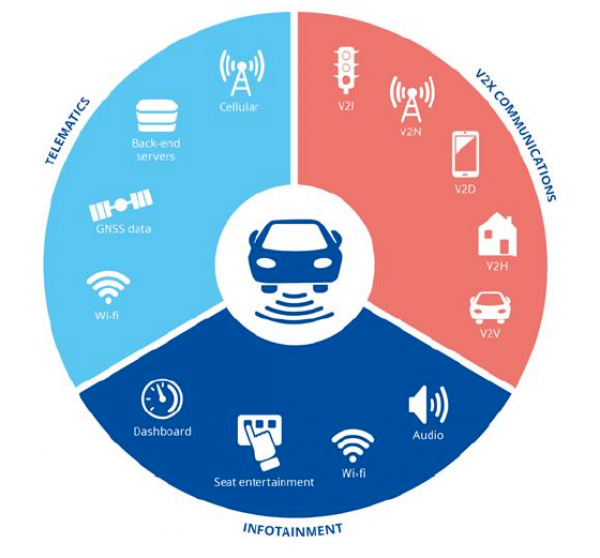

Vehicle data connectivity refers to the transmission of car data from modems embedded in the vehicle to communicate with other vehicles, infrastructure, or networks.

This data may include variables like location, speed, engine status, traffic conditions, and much more. Connected data is typically generated through the vehicle’s electronic control units (ECUs), Controller Access Networks (CANs), and even infotainment systems.

It is this connectivity that forms the foundation of autonomous vehicles.

The 7 types of vehicle data connectivity

The fully connected vehicle (or V2X for “vehicle-to-everything”) represents the pinnacle of automotive data potential. However, there are seven subcategories that define the different ways cars may connect to their environs:

- Vehicle-to-vehicle (V2V)

- Vehicle-to-network (V2N)

- Vehicle-to-infrastructure (V2I)

- Vehicle-to-cloud (V2C)

- Vehicle-to-pedestrian (V2P)

- Vehicle-to-device (V2D)

- Vehicle-to-grid (V2G)

It is important to note that these categories are not static; they are continuously evolving as technologies emerge and spark new synergies.

How does connected data impact the automotive industry?

Today’s leading global enterprises generate billions in profits from data-based services. With the advent of automotive IoT, mobility companies (equipment manufacturers (OEMs), car dealerships, and auto insurance companies) aspire to do the same.

Besides corporate profit, connected cars offer distinct customer advantages, and data shows there is consumer demand for such features. According to one McKinsey survey, 39% of car buyers were interested in purchasing accessory digital features. This number rose to 47% for buyers of premium vehicles.

Projections indicate that there will be over 400 million connected vehicles on the road by 2025, up from approximately 237 million in 2021. By 2030, experts predict that 96% of all vehicles will be connected. Given this trend, key players across the corporate and governmental sectors have invested in identifying viable use cases for this emergent data.

Use cases for Automotive Data

-

- Smart cities: By leveraging smart city apps, municipalities can use car data to reduce traffic congestion or identify accidents and other road hazards.

-

- Auto insurance: Some insurance companies are already using car data to determine driver behavior and adjust insurance rates accordingly.

-

- Advertising: Media agencies use this new data to expand their reach by tapping new customer touchpoints both inside and ouside of the car.

Challenges for Automotive Data

Though this new era of car connectivity holds promise, three main barriers have prevented mobility companies from successfully monetizing this data:

1. Failure to generate customer (or business) interest

Consumers today are well accustomed to receiving connectivity services through their smartphones. While these services seem to be free, they are paid for with data, which is a built-in smartphone expense.

When it comes to car connectivity, OEMs must convince their customers that the value connectivity services add to their automotive experience will offset the additional costs.

Furthermore, these services often come with costly installation or complex onboarding steps.

Failure to communicate these benefits has limited adoption in the consumer market. Even within the B2B sector, few are fully aware of the benefits that car connectivity provides.

2. Automotive leaders are slow to implement infrastructural change

In order to fully profit from connectivity, mobility companies need to reorganize their internal infrastructure and acquire talent to support their connectivity initiatives.

To date, few enterprises have built units dedicated to monetizing the vehicle’s entire life cycle. Instead, different stakeholders—from R&D to marketing and sales—work in silos, and opportunities to develop upgradeable features are lost.

3. Inability to scale

Widespread adoption of connected vehicles is impossible without the technological infrastructure, services, and data providers to support connectivity. But rather than working with these providers, OEMs are developing hard-to-scale solutions in singular partnerships with one other mobility brand (such as a gas or tire company).

As a result, there has been little progress on developing core competencies or differentiators. OEMs are also less likely to form partnerships in the B2B sphere than their peers in other sectors, making it difficult to serve the huge number of potential customers and obtain full value.

The future of car connectivity

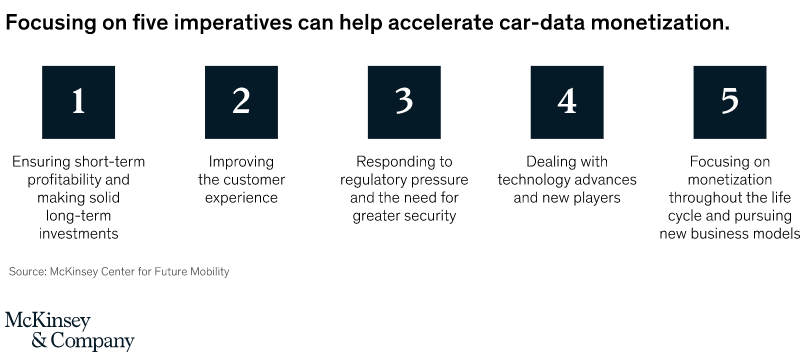

While automotive connectivity is poised for growth in the coming decade, McKinsey’s report identifies 5 imperatives for mobility companies to successfully monetize connected data:

- Connectivity services can pave the way for short-term profitability since they require relatively low initial investments, provide high margins, create recurring revenue streams, and have faster development timelines (as compared with many technologies).Simultaneously, mobility companies must invest in long-term technological advancement (especially in electrical and electronic (E/E) architecture and software) in order to remain competitive.

- OEMs are well poised to monetize their customer data because few mobility verticals have such regular and extensive interactions with their end customers. However, they will have to commit considerable effort toward improving UX as smartphones and other consumer services continue to raise the bar.

- Though vehicle data regulation is growing stricter across the globe, these guidelines may actually benefit mobility companies and consumers alike since they offer a clear framework for customer data. Similarly, investing in greater cybersecurity creates an opportunity for OEMs to garner consumer trust.

- Technological advancements in automotive connectivity are rapidly expanding the market. However, OEMs are no longer just competing against one another. They are competing against non-automotive tech companies (with strong consumer trust) that are edging into this space. To differentiate themselves, OEMs must define their make-versus-buy strategies and identify the truly differentiating key control points.

- As online sales and subscription models increase, OEMs should shift their focus to lifecycle monetization. To capture new opportunities, OEMs and suppliers are looking at OTA (over-the-air) feature updates and connected-service unlocks to generate new revenue streams throughout a vehicle’s life cycle.