Innovative Fintech Practices That Are Reshaping Telecommunications

Key takeaways:

- The diverse fintech applications that telcos are adopting and their benefits.

- The challenges and considerations in merging telecom and fintech.

- Future trends and strategic insights for telcos navigating the fintech space.

The intersection of telecommunications and financial technology is creating unprecedented opportunities for enterprises in both sectors.

As telcos face declining revenues and increased competition, they are exploring fintech solutions to innovate and enhance their service offerings. This strategic move is not merely about staying relevant; it’s about transforming how consumers interact with financial services through their telecom providers.

The integration of fintech by telcos promises to generate new revenue streams, foster financial inclusion, and deliver more personalized and secure customer experiences. By leveraging their extensive customer bases and technological infrastructure, telcos are uniquely positioned to revolutionize the financial landscape.

Explore how telcos are not just adapting to change but driving it, reshaping the future of both industries.

How Fintech Integration is Revolutionizing Telcos

Telecommunication companies, or telcos, are increasingly integrating financial technology (fintech) into their services, fundamentally altering the landscape of both industries. This convergence leverages the broad customer base and technological infrastructure of telcos to deliver innovative financial services. As a result, telcos can unlock new revenue streams and enhance customer engagement.

The Driving Forces Behind Telcos Adopting Fintech

Telcos are diversifying their service offerings by incorporating a range of fintech solutions such as digital banking, mobile payments, and blockchain technologies. This strategic move addresses several key objectives:

- Revenue Diversification: As traditional revenue streams from voice and data services decline, telcos are turning to fintech to generate new income sources. By offering financial services, telcos can tap into the profitable financial sector.

- Enhancing Customer Loyalty and Engagement: Fintech services provide added value to customers, fostering deeper relationships and increasing customer loyalty. Services such as the following convenience and flexibility, enhancing the overall customer experience.

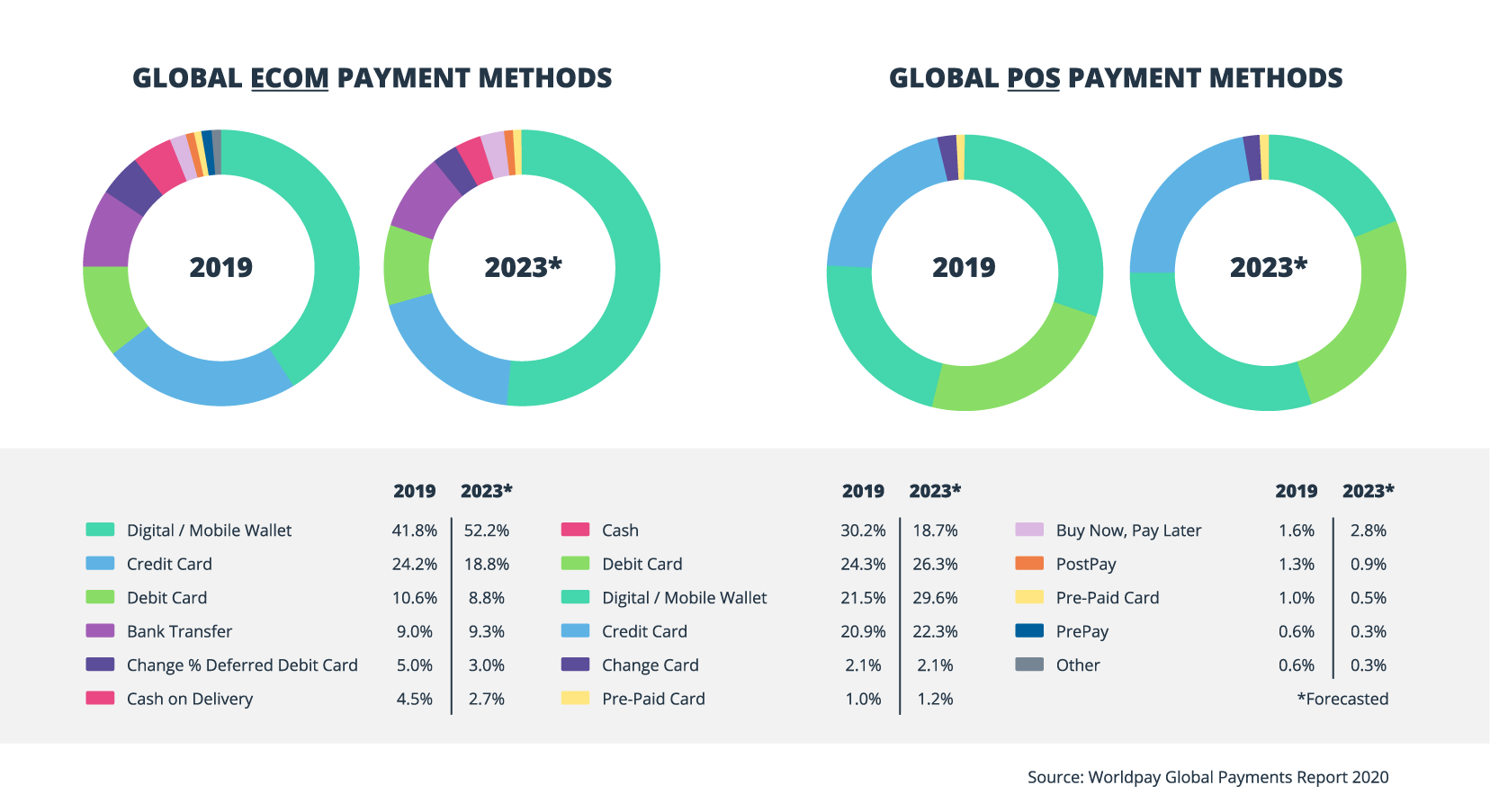

- Offer mobile wallets

- Digital banking

- Buy now, pay later (BNPL)

- Promoting Financial Inclusion: Many telcos operate in regions with significant unbanked or underbanked populations. By leveraging their extensive reach and technological capabilities, telcos can offer accessible financial services. Such initiatives promote financial inclusion and empower underserved communities.

The Dual Impact of Fintech on the Telecom Industry and Its Consumers

The integration of fintech is reshaping the telecom industry by transforming telcos into comprehensive service providers. This evolution impacts both the industry and consumers in several ways:

- Innovation and Competition: The entry of telcos into the fintech space drives innovation, encouraging traditional financial institutions to enhance their digital offerings.

- Improved Financial Services: Consumers benefit from more accessible, convenient, and secure financial services. Telcos’ fintech offerings often feature:

- Lower fees,

- User-friendly interfaces,

- And innovative solutions that traditional banks may not provide.

- Operational Efficiency: For telcos, integrating fintech solutions can streamline operations, improve data utilization, and enhance service delivery. Technologies like blockchain and AI-driven analytics can optimize processes and provide valuable insights, driving operational efficiency.

By embracing fintech, telcos are not only addressing current industry challenges but also positioning themselves as key players in the future of finance and digital connectivity. This strategic integration is paving the way for a more interconnected and inclusive financial landscape.

Unleashing the Power of Fintech Applications in Telecom

The integration of fintech solutions by telcos is transforming various aspects of the financial and telecommunications sectors. This section explores key applications that highlight the diverse ways in which telcos are leveraging fintech to enhance their services and expand their market reach.

The Rise of Mobile Banking Services in Telecommunications

Digital banking services are becoming increasingly popular among telcos. By leveraging their extensive customer bases and distribution networks, telcos can offer mobile banking services.

These services provide financial inclusion and generate new revenue streams. Innovations in mobile banking facilitate access to banking services and enhance customer convenience by offering 24/7 access through mobile platforms.

Additionally, they revolutionize credit scoring and provide branchless banking, making financial services more accessible and efficient for all users.

The Impact of Mobile Payments and Digital Wallets in Telecom

Mobile payments and digital wallets are among the most impactful fintech applications adopted by telcos. These services offer convenience, security, and a seamless payment experience for customers.

For instance, VodaPay by Vodacom is a comprehensive mobile app that consolidates various financial services, including the following:

- Payments

- Transfers

- Loyalty programs

The benefits include enhanced customer loyalty, improved financial management for users, and the creation of new revenue streams for telcos through transaction fees and value-added services.

Boosting Sales and Loyalty with Telcos’ BNPL Services

The Buy Now Pay Later (BNPL) model is gaining traction among telcos, offering customers the flexibility to make purchases and pay over time without immediate financial burden. These services allow customers to enjoy the following convenience for customers:

- Deferred payments

- Increasing sales

- Customer engagement

BNPL services help telcos tap into the growing demand for flexible payment options, fostering customer loyalty and boosting revenue.

The Impact of Web3 and Blockchain Technologies in Telecom

Telcos are adopting blockchain and Web3 technologies to enhance security, transparency, and decentralization in their operations. These technologies offer several key benefits:

- Create decentralized financial systems

- Improve data security

- Develop innovative use cases such as decentralized identifiers (DIDs)

The benefits include enhanced security, reduced fraud, and the ability to create new, decentralized financial ecosystems that operate independently of traditional financial institutions.

Telcos are leveraging fintech to not only enhance their service offerings but also to drive innovation and customer engagement. Adopting these applications positions telcos as key players in the evolving digital and financial landscapes. They provide valuable and convenient services to their customers, enhancing their competitive edge.

Critical Challenges in Integrating Fintech Solutions for Telcos

While integrating fintech into telecom services presents numerous opportunities, it also brings significant challenges and considerations. Addressing these issues is crucial for telcos to implement and sustain fintech solutions successfully.

Regulatory and Compliance Issues

One of the primary challenges telcos face when integrating fintech solutions is navigating the complex regulatory landscape. Financial services are heavily regulated, and telcos must comply with various legal and regulatory requirements.

These include anti-money laundering (AML) laws, data protection regulations, and financial reporting standards. For instance, in regions like Europe and North America, telcos must adhere to stringent data privacy laws such as the General Data Protection Regulation (GDPR).

To overcome these challenges, telcos often form strategic partnerships with established financial institutions to ensure compliance and leverage their regulatory expertise.

Technological Integration

Integrating fintech solutions with existing telecom infrastructure poses significant technological challenges. Telcos need to ensure that their networks can support the high transaction volumes and real-time processing required by financial services.

Additionally, integrating new fintech applications with legacy systems can be complex and resource-intensive. Collaboration with fintech firms and substantial investment in research and development (R&D) are essential to address these technological hurdles.

Security Concerns

Security is a critical concern in the fintech domain, given the sensitive nature of financial data. Telcos must implement robust cybersecurity measures to protect against threats such as:

- Data breaches

- Fraud

- Cyberattacks.

This includes deploying advanced encryption techniques, fraud detection systems, and secure authentication methods. Blockchain technology can also enhance security by providing a transparent and immutable ledger for transactions.

By addressing these challenges, telcos can successfully integrate fintech solutions. This strategic focus not only mitigates risks but also enhances the overall customer experience, paving the way for sustainable growth in the fintech space.

The Future of Fintech in Telecommunications: Trends and Strategies

The integration of fintech into the telecom industry is not just a current phenomenon but a trend poised to redefine the future landscape of both sectors. This section explores emerging trends and strategic recommendations for telcos to stay ahead in the evolving fintech environment.

Emerging Trends in Fintech for Telcos

Several key trends are shaping the future of fintech in the telecommunications sector:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are becoming integral to fintech solutions, providing the following:

- Advanced analytics

- Predictive insights

- Personalized customer experiences.

Telcos are leveraging AI to enhance credit scoring, detect fraud, and automate customer service.

- Internet of Things (IoT): The convergence of IoT and fintech is enabling innovative solutions such as connected devices for secure payments and financial transactions. This trend is expected to grow as more devices become interconnected, providing seamless and secure financial services through everyday objects.

- Quantum Computing: Quantum computing holds the potential to revolutionize fintech by solving complex optimization problems and enhancing data security. Although still in the beginning stages, telcos are beginning to explore quantum technologies to stay ahead in cybersecurity and financial analytics.

Strategic Recommendations

To capitalize on these trends and navigate the future landscape of fintech, telcos should consider the following strategic recommendations:

- Invest in Innovation and R&D: Continuous investment in research and development is crucial for telcos to innovate and stay competitive. This includes exploring new technologies such as AI, blockchain, and quantum computing to develop advanced fintech solutions.

- Form Strategic Partnerships: Collaborating with fintech startups, financial institutions, and technology providers can help telcos access new technologies. These partnerships also provide regulatory expertise and innovative solutions.

- Focus on Customer-Centric Solutions: Telcos should prioritize customer needs by developing user-friendly, secure, and personalized financial services. Leveraging data analytics and AI can help telcos understand customer behavior and preferences. This enables them to offer tailored solutions that enhance customer satisfaction and loyalty.

- Emphasize Security and Compliance: Ensuring robust security measures and compliance with regulatory standards is paramount. Telcos must continuously update their security protocols and stay informed about regulatory changes to protect customer data and maintain trust.

- Expand Financial Inclusion: By leveraging their extensive reach, especially in underserved regions, telcos can promote financial inclusion by providing accessible and affordable financial services. This not only drives social impact but also opens new market opportunities.

Leveraging data analytics and AI can help telcos understand customer behavior and preferences. These insights enable them to offer tailored solutions that enhance customer satisfaction and loyalty.

Embracing Fintech for Innovation and Growth in Telecom

The integration of fintech solutions within the telecommunications industry is driving significant changes, creating new opportunities, and transforming how financial services are delivered. Embracing fintech allows telcos to enhance their service offerings, foster innovation, and expand their market reach.

Adopting these strategies enables telcos to address current industry challenges while positioning themselves as leaders in the future of finance and digital connectivity. The convergence of telecommunications and fintech is paving the way for a more interconnected, secure, and inclusive financial landscape.

To delve deeper into the transformative potential of fintech in telecommunications, consider signing up for a free entrapeer account. Gain access to comprehensive market insights, detailed research, and tailored reports that can drive your strategic decisions.

Sources

- https://gdpr.eu/what-is-gdpr/#:~:text=The%20General%20Data%20Protection%20Regulation,to%20people%20in%20the%20EU.